By Laser 1 Technologies

Manufacturing Job Recovery Region

Manufacturing jobs are a useful metric to keep an eye on, if you’re in the manufacturing industry. They represent an interesting intersection between the state of the industry and the state of the economy as a whole.

A recent blog article in Liberty Street Economics offered some careful analysis of the employment climate in the manufacturing arena. This is not just any blog, either: it’s published by the New York Fed. “The Federal Reserve Bank of New York is one of 12 regional Reserve Banks which, together with the Board of Governors in Washington, D.C., make up the Federal Reserve System,” as they explain on their site. “The Fed, as the system is commonly called, is an independent governmental entity created by Congress in 1913 to serve as the central bank of the United States.

In other words, authors Jaison R. Abel and Richard Deitz, both VPs at the NY Fed, have both the smarts and the resources to do some in-depth analysis.

The New York Fed Offers Detailed Analysis

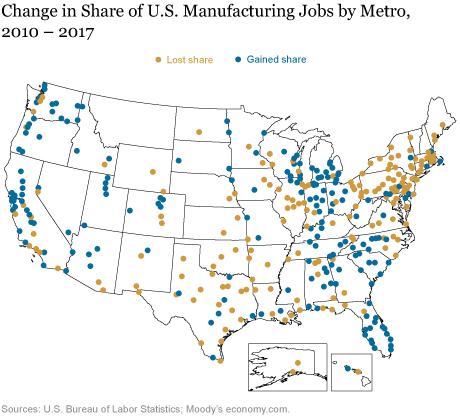

In their article, Where Are Manufacturing Jobs Coming Back?, they’re looking at the trends in manufacturing jobs in the 21st century. First, the U.S. “lost close to six million manufacturing jobs between 2000 and 2010 but since then has gained back almost one million.” Ouch. That’s only a recovery of about 17%. And of course, the gains have not happened proportionally across the board, and that’s the focus of the article. Where were the losses the strongest, where were they the weakest? Where is recovery the strongest, where was it the weakest?

They start with the big picture, dividing the U.S. into nine regions according to the census.

While job losses during the 2000s were fairly widespread across the country, manufacturing employment gains since then have been concentrated in particular parts of the country. Indeed, these gains were especially large in “auto alley”—a narrow motor vehicle production corridor stretching from Michigan south to Alabama—while much of the Northeast continued to shed manufacturing jobs. Closer to home, many of the metropolitan areas in the New York-Northern New Jersey region have been left out of this rebound and are continuing to shed manufacturing jobs, though Albany has bucked this trend with one of the strongest performances in the country.

To illustrate where jobs have been growing and declining, the chart below shows the percentage change in manufacturing employment by census region from 2000 to 2010 and from 2010 to 2017. Declines were significant for every region of the country between 2000 and 2010, though there were some notable differences. While employment fell 30 to 40 percent in most regions, the Mountain, West North Central, and West South Central regions saw more modest declines.

Regional Winners and Losers

Next, they offer a map of the US, with colored dots illustrating which regions gained in share of manufacturing jobs since 2010. This map brings it home at a glance. “Auto alley,” the West Coast, and Florida look good. West South Central (Texas, Louisiana, Arkansas and Oklahoma), the Mid-Atlantic and New England are in trouble.

They then break it down by New York state metropolitan areas, delivering some other interesting tidbits:

- The computer and electronics industry… continued to shed jobs between 2010 and 2017. Many of these job losses accrued to companies involved in defense contracts, as some of these firms saw their business decline due to public sector spending cuts.

- Albany saw its manufacturing job base grow by nearly a third between 2010 and 2017, which was among the largest gains in the country over the period. This job growth largely reflects the successful establishment of a nanotechnology cluster and related semiconductor chip manufacturing in the Capital region.

If you find this topic as compelling as I do, be sure to read the original article, which has some excellent graphs, charts and maps. While this kind of macro information is hard to put to use in a day-to-day way at the manufacturing plant, it offers really valuable insights into the larger trends which will impact all of our businesses.