By Laser 1 Technologies

Buying or Leasing Expensive Machinery

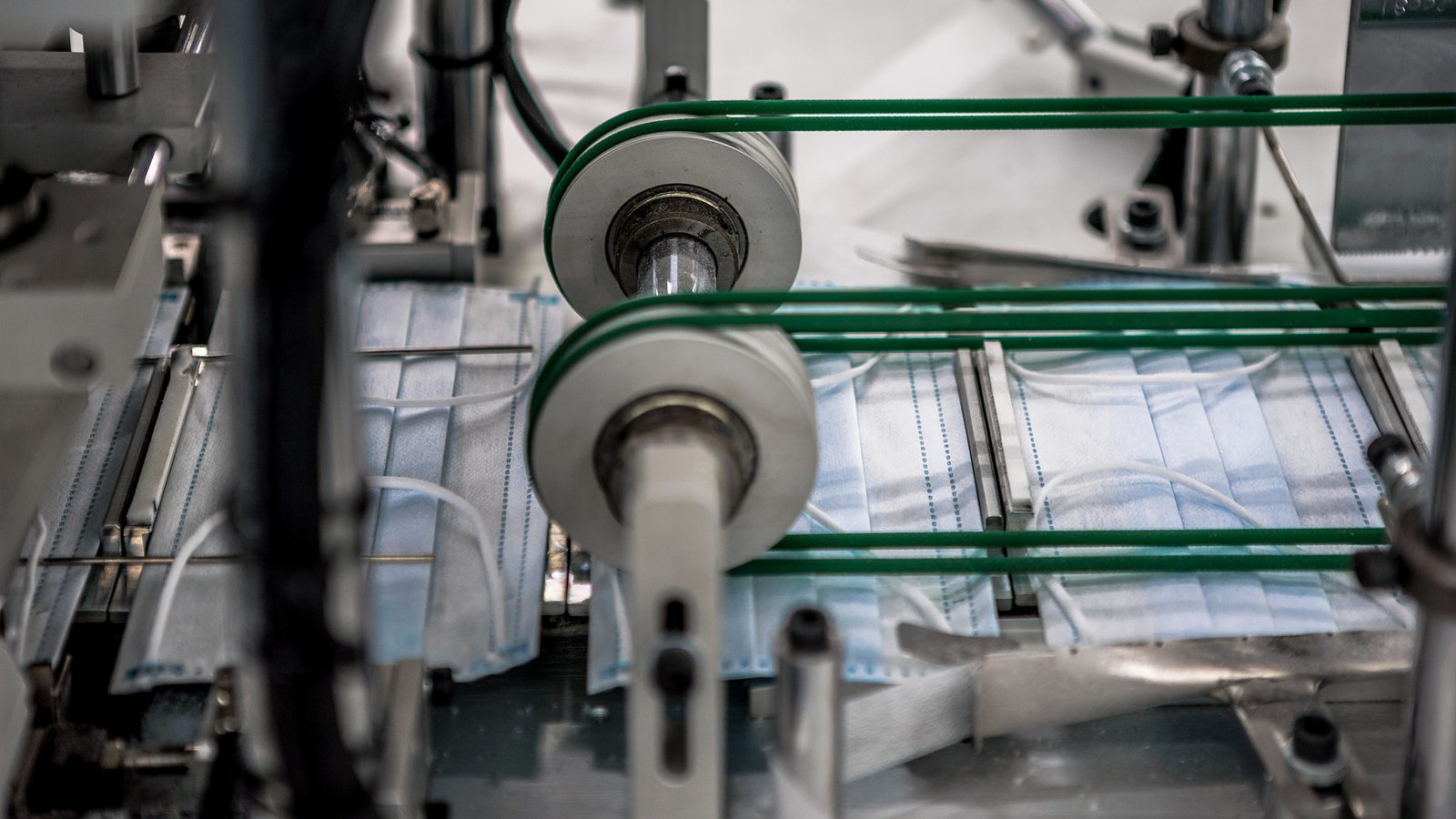

For a small business, deciding whether to purchase new, expensive machinery is a challenge. As equipment ages, it increasingly becomes a liability rather than an asset. Data from the accounting department can alert you that it’s time to replace equipment.

Evaluating: Is it Time to Replace Equipment?

First, look for the rising cost of repair and maintenance. Track this information by the individual pieces of equipment, and data may start to show that your company spends increasing money on repairs while still making monthly payments to the bank for the machine.

Second, production capability typically decreases over time. New technologies and equipment reduce the production cycle and improve the quality of products, while with old equipment, the production cycles stay the same. Consequently, a business loses its competitiveness because other companies are producing the same product at a lower price with their updated equipment. Obvious red flags include lower or flat revenue, lower RFQ (request for quote) conversion rate, and increasing direct costs.

So when you’ve established that it’s a financial imperative to replace equipment, you face the decision: buy or lease?

Factors Influence the Buy-Versus-Lease Decision

Capital expenditure decisions aren’t simple. Factors that influence a buy-versus-lease decision include company profit (money available for re-investment), cash flow, and growth strategies.

I recommend starting by defining clear growth strategies, and verifying them via financial calculations. Guessing is not an option.

Option 1: Purchase with Ten Years Financing

Let’s say a business wants to acquire equipment valued at $800,000. A typical approach would be purchasing the equipment and spreading payments over ten years, perhaps using SBA (Small Business Administration) financing. The arguments in favor of purchase are based on favorable depreciation and lower monthly payments. Coming up with a down payment may be the first struggle: At 20% that amounts to $160,000. not including hefty fees if financed by the SBA.

This money has to be paid up front, which is a significant dent to cash flow. In addition, the financed amount goes to the balance sheet, increasing the company’s liabilities. Over time, the total amount paid can reach a million dollars, with a quarter of a million dollars in interest.

It may make a lot of sense to go that route, if that piece of equipment will last over ten years with relatively low cost of maintenance and a consistent (and acceptable) level of productivity. In many cases, the equipment can be used for more than ten years, but inevitably it loses production competitiveness and market value.

To choose the right option, consider several financial and strategic scenarios. For example:

- OPTION 1: Purchase with ten years financing (above)

- OPTION 2: Purchase with five years financing

- OPTION 3: Five year lease

Option 2: Purchase With Five Years Financing

Purchase Price $800,000

Down Payment $160,000

Amount to Finance $640,000 at 6% for 5 years

Monthly Payment $12,373

Total Cost $742,380

Interest $102,380 (= 14%)

The base for depreciation is $800,000. There are several methods of depreciation, so for illustration purposes let’s use the MACRS 5 year depreciation schedule (half-year conversion).

Year Percentage Amount

1 20.00% $160,000

2 32.00% $256,000

3 19.20% $153,600

4 11.52% $92,160

5 11.52% $92,160

6 5.76% $46,080

Total $800,000

Cash flow keeps a business alive, and a business cannot operate on negative cash flow. In this scenario the total cash outflow is $902,380 (down payment and monthly payments). Consequently, two calculations have to be performed: required additional revenue and ROI (return on investment).

Important note: the value of the equipment will be shown on the balance sheet as a liability. With every payment the amount of interest is transferred to the P&L (profit and loss) as an expense, and increased principal reduces liability on the balance sheet. Depreciation reduces the taxable income only, which means that company holds on to cash and pays less taxes.

Option 3: Five Year Lease

Equipment Price $800,000

Amount to Finance $800,000 at 6% for 5 years

Monthly Payment $12,015

Total Cost $732,900

Interest $162,900 (= 22%)

Residual (Market) Value $230,000

Leasing does not require a down payment. Some documents and processing fees will apply. Here, the business retains $160,000 and the monthly payment is almost the same as in Option 2.

In this scenario, the major differences between buying and selling are that the business’s outflow of cash has been reduced to $732,900 versus $902,380 (saving $169,480) and the business has other options at the end of the lease. It can refinance $230,000; trade for a new equipment; or possibly sell the equipment for more than $230,000 keeping the difference.

Keep Tax Considerations in Perspective

One may ask, “Why should I go to these lengthy calculations? I’ve always been advised to purchase equipment, especially by the end of the year.” That still could be a valid point if the only one thing on the owner’s mind is to pay less taxes, but there are other means to lower your taxes and to have $160,000 to save, invest, distribute among the shareholders, etc.

Obsolescence Is Expensive

The above examples illustrate a strategy to decide between buying and leasing. Technology and inevitable obsolescence are primary factors in these type of decisions. Regardless of the size or price of the equipment, technological advances make almost any equipment obsolete within four to five years. Businesses that are willing and able to replace their machinery within this window can stay competitive.

As equipment improves so rapidly, capital investment strategy with calculated consideration of revenue growth and lower manufacturing costs is more important than ever.

Of course, this is a highly complicated topic reduced to a simple analysis above for the purpose of illustration. Your feedback and comments are appreciated. If you would like to discuss these matters with me, please call me at 651-451-3444.